This is because the correct amount. If you are employed.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income.

. Is there a separate income tax form for non-resident instead of the standard PND 90. This maximum investment amount is decided by the government. My support is about THB 30000 per month from family friends.

Basis Period for Company. April 6 2006 1207 PM Income Tax 95 b the provisions of this Act shall apply to any adjusted loss of the surrendering company which is not. Introduction Individual Income Tax.

Ownership Costs such as those incurred when searching and inspecting for properties. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. The Income-tax Act of India has a number of sections that taxpayers can use to reduce their taxes.

I have closed my tax file in Malaysia when I relocated to Thailand. Calculations RM Rate TaxRM A. Presumptive Taxation Freelancers can also use the Presumptive Taxation method and escape the tedious task of account bookkeeping when they earn an income less than Rs 50 Lakhs during the given financial year.

Shall be taken to form part of such period or that period. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Deduction of tax from gains or profits in certain cases derived from Malaysia 109 G.

See the Departments circular note dated April 10 1991. As a result most employees will not be required to lodge Form S returns. Income Tax Exemption No.

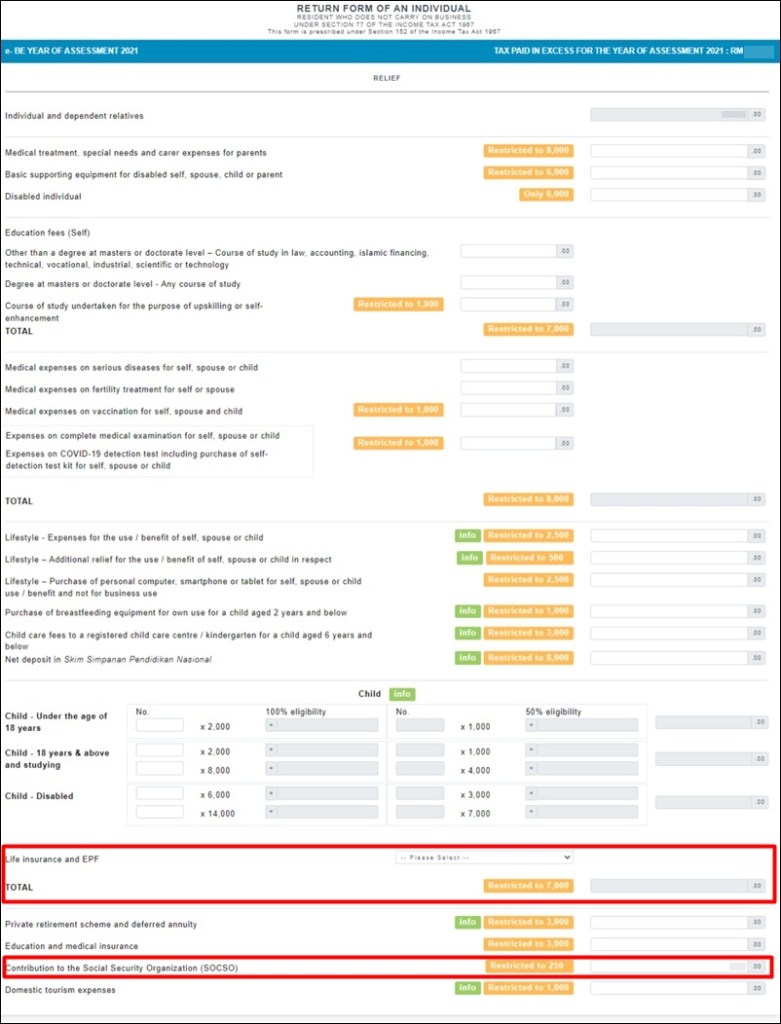

Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. How To Pay Your Income Tax In Malaysia. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

Employment income includes salaries wages allowances and subsidies remuneration in all forms benefits earned for participation in business associations boards of directors control boards management boards and other organizations premiums and bonuses in any form except those received from the State. Title Costs such as the legal fees incurred when organising and. FREQUENTLY ASKED QUESTIONS - FORM B PART 1.

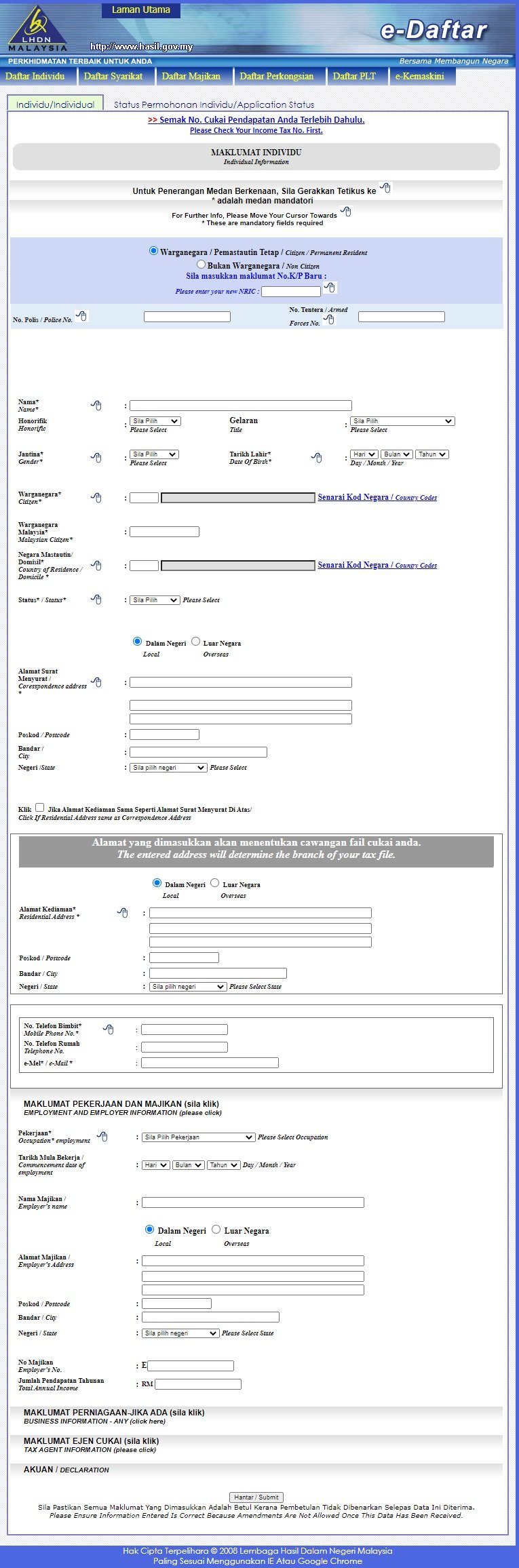

Guide To Using LHDN e-Filing To File Your Income Tax. On the First 5000 Next. Headquarters of Inland Revenue Board Of Malaysia.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Deduction of tax on the distribution of income of a unit trust 109 E.

CIT estimated payment due dates. The expenses that investors can add to a cost base include but are not limited to. Income tax information for A or G visa holders.

Form B needs to be furnished by an individual who is resident in Malaysia and carries on a business. On the First 5000. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

5 Order 2022 Exemption of FSI received by resident individuals. Students get proper knowledge about Business Tax Accounts along with the administration part at the basic stage. B Com is a 3-year Undergraduate program that focuses on subjects related to commerce Economics Business Law Accountancy Taxation and finance.

First of all you need an Internet banking account with the FPX participating bank. Tax must be paid no later than three months after closing of the corresponding accounting period. Six nine and 12 months after the end of the taxable year.

Amending the Income Tax Return Form. Tax Offences And Penalties In Malaysia. Amending the Income Tax Return Form.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this. What is the difference between Form BE and Form B. CIT final payment due date.

Deduction of tax from income derived from withdrawal of a deferred annuity or a private retirement scheme 109 H. The participating banks are as follows. Expenses That Can be Added to the Cost Base.

Three months after the end of the fiscal year. Incidental Costs such as your rental advertisement fees legal fees and stamp duty. Following the announcement made by MOF on 30 December 2021 the following Exemption Orders have been gazetted on 19 July 2022.

B Com full-form is Bachelor of Commerce. Locally hired foreign mission employees If you are permanently resident in the United States for purposes of the Vienna Conventions you are not entitled to the income tax exemption available under the Vienna Conventions. However every section amongst these has a pre-set maximum investment amount.

1 Pay income tax via FPX Services. Here are the many ways you can pay for your personal income tax in Malaysia. If you fail to pay this tax there would be interest charged on your final tax account under the Section 234 B and 234 C of the Income Tax Act.

Change In Accounting Period. Change In Accounting Period. Whereas the category of non-residents individuals companies etc still remain eligible for income tax exemption.

Corporate income tax CIT due dates CIT return due date. How To File Your Taxes Manually In Malaysia. Who needs to furnish Form B.

BE Form - income assessed under Section 4 b - 4 f of the Income Tax. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Basis Period for Company.

Throughout Malaysia--28 September 1967. Deduction of tax on the distribution of income of a family fund etc. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D.

PAYE became a Final Withholding Tax on 1st January 2013. Jul 25 2019 at 351 am.

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To File Your Taxes For The First Time

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

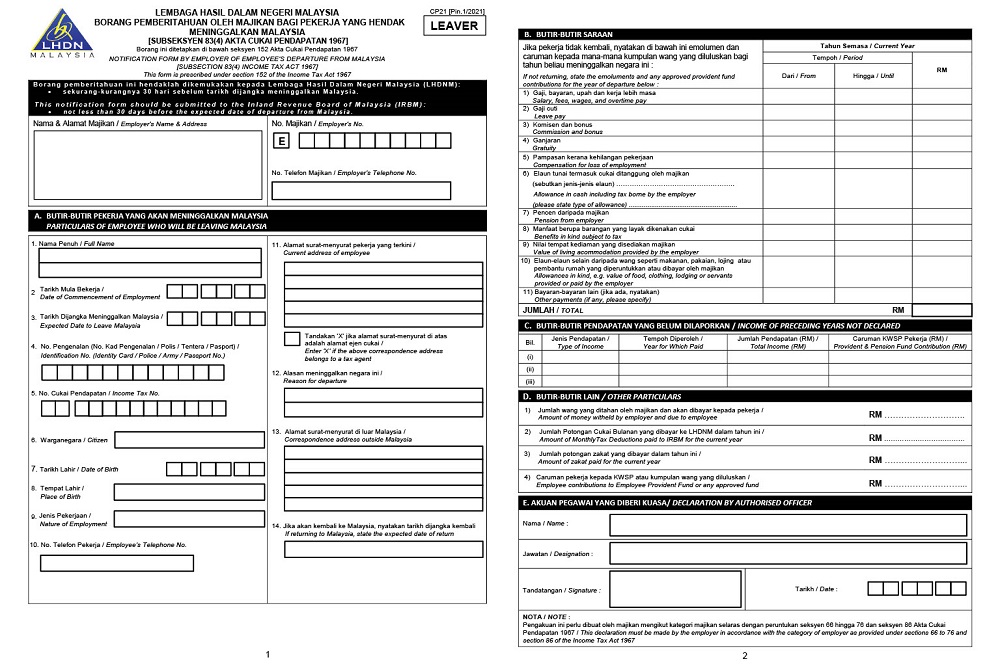

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Understanding Lhdn Form Ea Form E And Form Cp8d

New Restaurant Cash Handling Policy Template Invoice Sample Invoice Template Word Invoice Template

Contoh Payslip 10 Sweep18 5 Things Know Epf Wecanfixhealthcare Info Belajar Desain Resume Cv Kreatif

Business Income Tax Malaysia Deadlines For 2021

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

A Pay Stub Or Paycheck Stub Is A Document That Is Issued To By An Employer To His Her Employee As A Notification That Payment Payroll Checks Payroll Templates

Business Income Tax Malaysia Deadlines For 2021